do you pay taxes on inheritance in north carolina

This tax applies to any individual who inherits a property worth over 1206 million. All Major Categories Covered.

Mcintyre Elder Law Do I Have To Pay Tax On The Home I Inherited

However residents of the state should keep in mind that they are subject to.

. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. North Carolinas income tax is a flat rate. An inheritance of 382 million falls into the highest tax rate so youll have to pay 40.

As of 2021 the six states that charge an inheritance tax are. Do you have to pay inheritance tax in North Carolina. In North Carolina you are not required to pay state estate tax or inheritance tax.

If you die within. What is the current inheritance. The federal estate tax exemption is 1158 million in 2020 so only estates larger than that amount will owe federal.

However residents of North Carolina may still face an estate tax on a federal level. What is the North Carolina estate tax exemption for 2021. Select Popular Legal Forms Packages of Any Category.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. The state of North Carolina requires you to pay taxes if you are a resident or nonresident. This is known as the 7 year rule.

With the property tax your federal tax would be 187 million. The 7 year rule No tax is due on any gifts you give if you live for 7 years after giving them unless the gift is part of a trust. Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky.

North Carolina does not collect an inheritance tax or an estate tax. How much can you inherit and not pay taxes. North Carolina residents do not need to worry about a state estate or inheritance tax.

The current Federal Estate Tax Exemption for 2021 is 117 million per individual. However - there is no inheritance taxes on neither federal nor state level in North Carolina. Estate taxes are imposed on the total value of the estate - if the total estate value.

Social Security is not taxed but other retirement income sources are fully taxed. Inheritance tax rates differ by the state. Additionally you may face estate taxes if you inherit property located in another state while living in North Carolina.

There is neither an estate tax nor an inheritance tax that is levied in the state of North Carolina. That is 152 million. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million.

Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving. In this situation the other states laws on estate tax generally apply which may end up costing. Estate tax or inheritance tax.

However there are 2 important exceptions to this. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. North Carolina does not have these kinds of taxes which some states levy on people.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. North Carolina is moderately tax-friendly for retirees.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Creating Racially And Economically Equitable Tax Policy In The South Itep

Complete Guide To Probate In North Carolina

How Do I Figure Out The Value Of My Estate Rania Combs Law Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Transfer On Death Tax Implications Findlaw

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

How To Transfer A Car Title In South Carolina Yourmechanic Advice

North Carolina Estate Tax Everything You Need To Know Smartasset

Tax Free Inheritance Irs Portability Rule Allows Transfer Of Up To 12 06 Million Gobankingrates

North Carolina Estate Tax Our Top Strategies Irs Pitfalls

Tax Consequences When Selling A House I Inherited In Massachusetts Pavel Buys Houses

State Death Tax Hikes Loom Where Not To Die In 2021

How To Avoid Paying Taxes On Inherited Property Smartasset

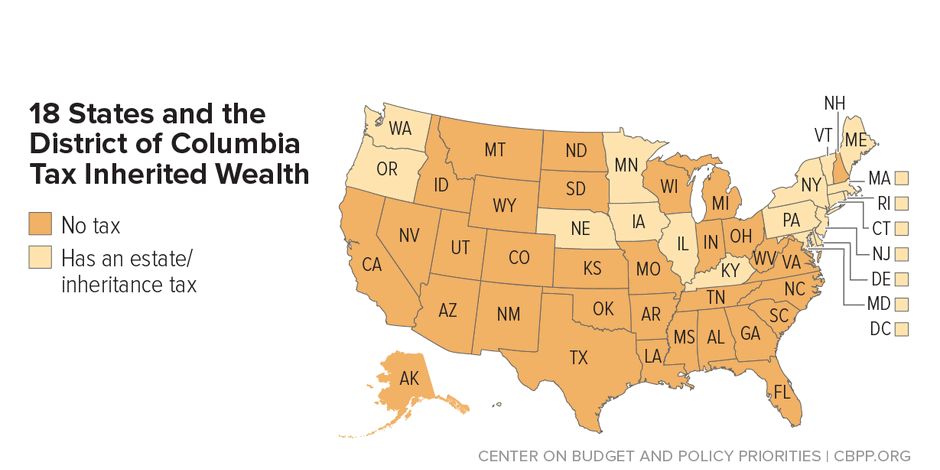

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A